2026 Predictions

AI, Big Tech, Hollywood, & more

Merry Christmas and Happy Holidays!

The mistake most forecasts make is treating technological change as something abstract or moralized, instead of something drives moves balance sheets, labor markets, and capital allocation.

In 2026, the winners will not be the loudest labs or the most rhetorically careful institutions. They will be the ones that reduce friction, compress time, and replace uncertainty with repeatability. These predictions are not about hype cycles. They are about where incentives are already pointing.

So without further ado, here are my predictions for 2026.

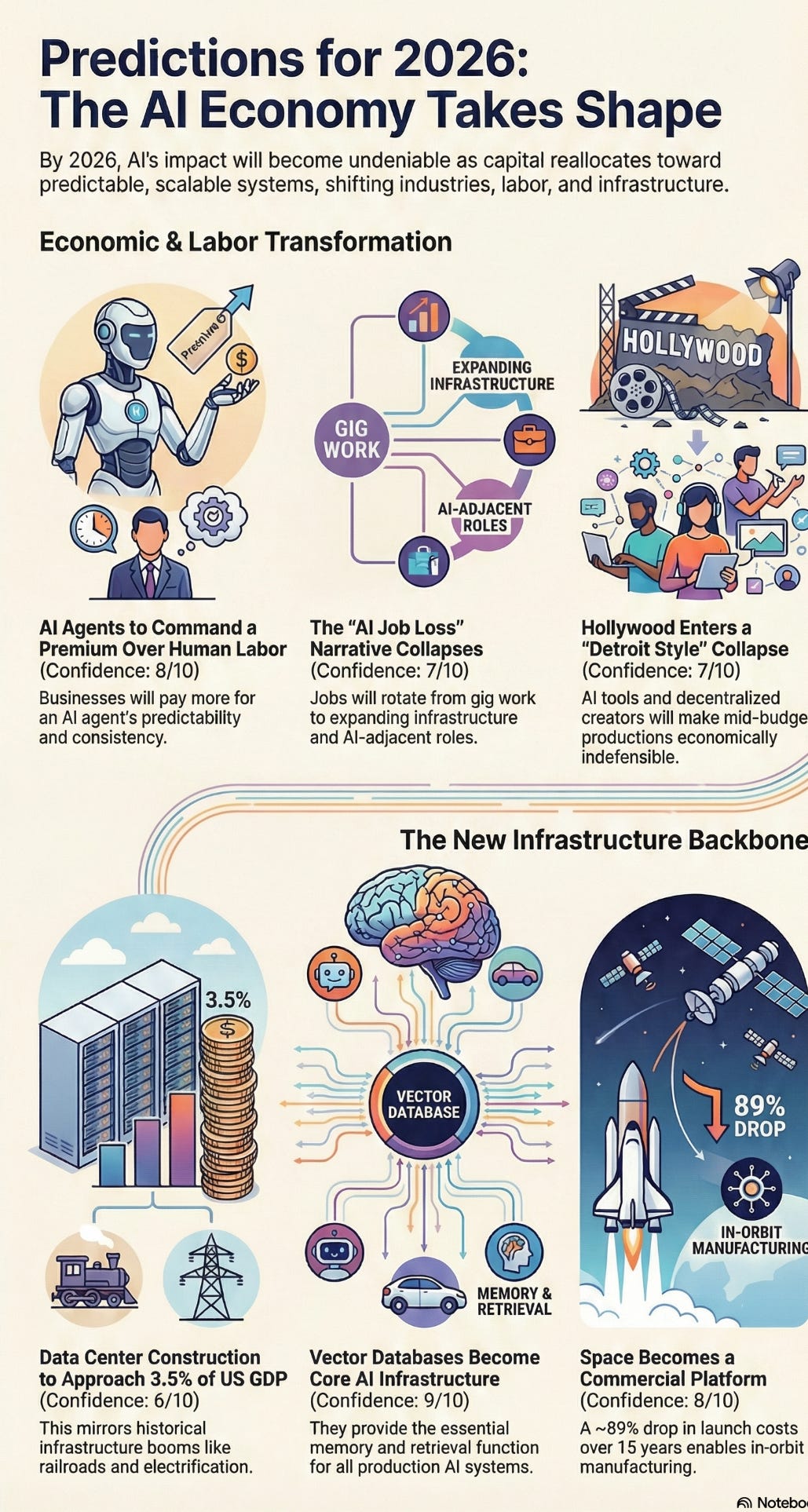

AI Agents Will Command a Premium Over Human Labor

Confidence 8 out of 10

Businesses will pay more for AI agents than for people for the first time.

This sounds extreme until labor is priced correctly.

A human employee carries a visible cost in wages and benefits. They also carry invisible costs. Recruiting fees. Onboarding time. Training half life. Managerial oversight. Churn. Internal coordination drag. Compliance exposure. Output variance. These costs do not appear cleanly on a P&L, but they are real and persistent.

AI agents collapse many of these variables. They have higher upfront costs, but near zero churn. Zero onboarding time after deployment. No training decay once tuned. No social variance. No renegotiation. Output consistency becomes the feature.

There is already a consumer analog. Waymo rides cost roughly 31% percent more than Uber rides on average in the same markets. Yet demand is still growing. Riders pay the premium because the experience is more predictable. Fewer safety incidents. No driver variability. Lower cognitive load. Reliability beats price.

Enterprises behave the same way. When a task is rote, repeatable, and economically important, predictability dominates wage arbitrage. Once CFOs price total cost of labor instead of hourly cost, paying more for an agent becomes rational.

Precautionary thinking says firms will hesitate because AI feels risky. That logic collapses the moment variance shows up as margin loss.

Companies positioned to benefit

OpenAI

Anthropic

ServiceNow

Sierra

Vector Databases Become the Core AI Infrastructure Layer

Confidence 9 out of 10

Vector databases will explode in revenue because modern AI systems cannot function without them.

Large models do not fail because they lack intelligence. They fail because they lack memory. Prompt engineering does not scale. Fine tuning is brittle. Retrieval is the only durable solution.

As multimodal models and world models proliferate, the volume of embeddings grows dramatically. Text. Images. Video. Audio. Sensor data. Enterprise documents. The connective tissue between these embeddings and the model is vector search.

This is not theoretical. Every production deployment converges on the same architecture. Foundation model. Embedding layer. Vector database. Orchestration. Application.

The counterargument claims vector databases will be commoditized. This misunderstands where value accrues. The value is not storage. The value is latency under load. Recall quality. Hybrid search. Access control. Observability. Operational tooling. Enterprises do not casually rebuild these systems.

As AI becomes more agentic, vector retrieval becomes the memory substrate. That makes it non-optional.

Companies positioned to benefit

Pinecone

Weaviate

MongoDB

Amazon Web Services

Google Forces Specialization by Winning on Breadth

Confidence 7 out of 10

The era of every major lab competing as a generalized frontier model provider is ending.

Not because they lack ambition. Because it is economically unsustainable.

Google operates frontier models, on device inference, video generation, open weight releases, and global search distribution simultaneously. No other organization sustains that breadth. That does not mean Google wins every benchmark. It means Google sets the baseline pace.

Once an actor sets the tempo across domains, others are forced into specialization. Capital intensity rises. Marginal benchmark gains shrink. Differentiation shifts away from raw capability toward vertical integration and distribution.

This is already visible. Anthropic optimizes for enterprise reliability and coding workflows. OpenAI protects consumer distribution and developer platforms. xAI builds massive coherent GPU clusters and leans into deep research and model scale. These are not temporary tactics. They are structural responses.

Precautionary narratives frame this as dangerous concentration. Historically, this is how ecosystems mature. Breadth defines the baseline. Depth defines survival.

Companies positioned to benefit

Google

Anthropic

OpenAI

xAI

Data Center Build Out Makes Up 3.5% of US GDP

Confidence 6 out of 10

Data center construction will expand past three and a half percent of US GDP by the end of 2026.

That number sounds implausible until it is contextualized. Railroads. Electrification. Highways. All consumed similar GDP shares during their expansion phases. Compute is now a general purpose input. AI demand is not niche demand.

The constraint is not appetite. It’s financing.

Private credit markets carry the bulk of this expansion. If default rates rise meaningfully, build out slows sharply. If perceived risk increases, capital pulls back. Energy availability, permitting delays, and grid interconnection are secondary bottlenecks.

Precautionary thinking assumes restraint will be chosen deliberately. History shows otherwise. Build out continues until financing breaks. Warnings do not stop capex. Balance sheets do.

Companies positioned to benefit

Amazon

NVIDIA

Equinix

Brookfield

Amazon as the Big Tech Winner of 2026

Confidence 7 out of 10

Amazon’s advantage is not narrative. It is physics.

AI and robotics compress the time it takes to move atoms. That matters more than model benchmarks. Amazon has reduced click to ship time by 78% in key fulfillment networks. That changes inventory dynamics. Faster turns. Lower working capital. Higher throughput.

Robotics do not behave like labor. They behave like depreciating assets. Once amortized, they flip from cost center to profit engine. OPEX stays flat. Volume grows. Margins expand quietly.

In 2025, Amazon traded around a multiple of 33, well below its historical average near 58. That discount reflects narrative fatigue, not operational weakness.

AWS compounds the story. If vector databases and enterprise AI infrastructure grow as expected, value accrues directly through cloud consumption.

Companies positioned to benefit

Amazon

Amazon Web Services

NVIDIA

Kiva Systems

Space Becomes a Real Commercial Frontier,

Confidence 8 out of 10

The cost to send a kilogram of payload into orbit has fallen roughly eighty nine percent over the last fifteen years. This is not cyclical. It is structural. Reusability permanently changed the slope.

Blue Origin successfully landing New Glenn on a platform in the Pacific is not symbolic. It confirms that competition in launch economics is real. SpaceX forced the cost curve down. Others are now following.

As launch costs fall, space becomes economically useful. Microgravity pharmaceutical research. Advanced materials. Crystallization. Manufacturing that is cheaper in orbit than on Earth. Companies like Varda exist because simulating space conditions on Earth is often more expensive than using space itself.

Compute and energy follow. Thermal dissipation is trivial. Solar energy is abundant. Orbital infrastructure stops being science fiction once launch is routine.

Precautionary skepticism here mirrors early internet skepticism. Once access becomes cheap and frequent, experimentation accelerates.

Companies positioned to benefit

SpaceX

Blue Origin

Varda Space Industries

Rocket Lab

Hollywood Enters a Detroit Style Collapse

Confidence 7 out of 10

Hollywood is not declining gracefully. Its being undercut.

AI collapses production costs. Decentralized creators collapse distribution moats. The middle of the market becomes economically indefensible. Mid budget productions lose to small teams with AI tooling and direct audience relationships.

Blockbusters survive. Everything else is hollowed out. ROI replaces prestige. Short form and mid form content capture attention and monetization more efficiently.

Precautionary resistance from legacy institutions slows nothing. Audiences have already moved. Capital follows efficiency.

Companies positioned to benefit

YouTube

TikTok

OpenAI

Runway

The AI Job Loss Narrative Quietly Dissipates

Confidence 7 out of 10

Mass unemployment makes for compelling headlines.

What actually happens is job rotation. Gig work declines. Infrastructure work expands. As data center build out accelerates, demand rises for electricians, energy workers, logistics operators, warehouse staff, maintenance crews, and AI adjacent human labor.

People do not vanish from the economy. They move. An Uber driver displaced by autonomy does not disappear. They become a warehouse operator. A logistics coordinator. A data labeler. An AI auditor. These roles exist because humans remain useful. Automation is middle to middle. Humans are end to end.

Gig work offers flexibility, but little mobility. Infrastructure work offers upward social mobility. Vocational training follows demand.

Precautionary thinking assumes people cannot retrain. History repeatedly disproves this when incentives align.

Companies positioned to benefit

Amazon

Surge AI

Palantir

Siemens

A Toast to 2026

Across every serious forecast, one truth stands out with unmistakable clarity. Prosperity does not flow from hesitation. It flows to those enterprises and industries that master reliability, that compress time, that turn uncertainty into systems that can be scaled, trusted, and sustained. History has never rewarded confusion for long, and markets do not reward it now.

Too often, precaution is mistaken for wisdom. Hypothetical dangers are magnified, while real incentives are ignored. By 2026, this imbalance will no longer hide behind good intentions. It will stand exposed as a choice, and not a neutral one.

There is always risk in choosing a direction. But history tells us that the greater risk lies in standing still. Those who argue for slowing progress believe they are buying safety. In truth, they are surrendering it. A policy of deceleration offers no middle ground, only the illusion of control while others move ahead.

We will not conquer climate instability, disease, or declining living standards by restraining innovation or redistributing scarcity. We will not build a stronger nation by telling our most capable people to wait their turn. These challenges are not solved by retreat, but by resolve.

The path forward is acceleration. Acceleration in energy abundance. Acceleration in intelligent systems that multiply human capability. Acceleration toward a civilization that reaches beyond this planet, that cures genetic illness at its root, and that expands opportunity instead of rationing it. That is not recklessness. That is progress, and it has always been the American way.

You and I have a rendezvous with destiny.

We’ll preserve for our children this, the last best hope of man on earth, or we’ll sentence them to take the last step into a thousand years of darkness.

—Ronald Regan, October 27, 1964

🇺🇲 Hey Matt, check out the Numbers!⚡⚖️🛢️⚙️

(politicians HATE energy balance equations!)

🤓🇦🇹💸🔔 Austrian Economics:

https://claude.ai/public/artifacts/3b840713-71b1-4bc4-b19e-9ec4487a1860

Great Stuff!

I add these into my Accel / Decel chats with Claude.ai

I'm a cautious Accel myself,

Olde Dawg / knew tricks.