Foundational Models Will Get Commoditized

So What

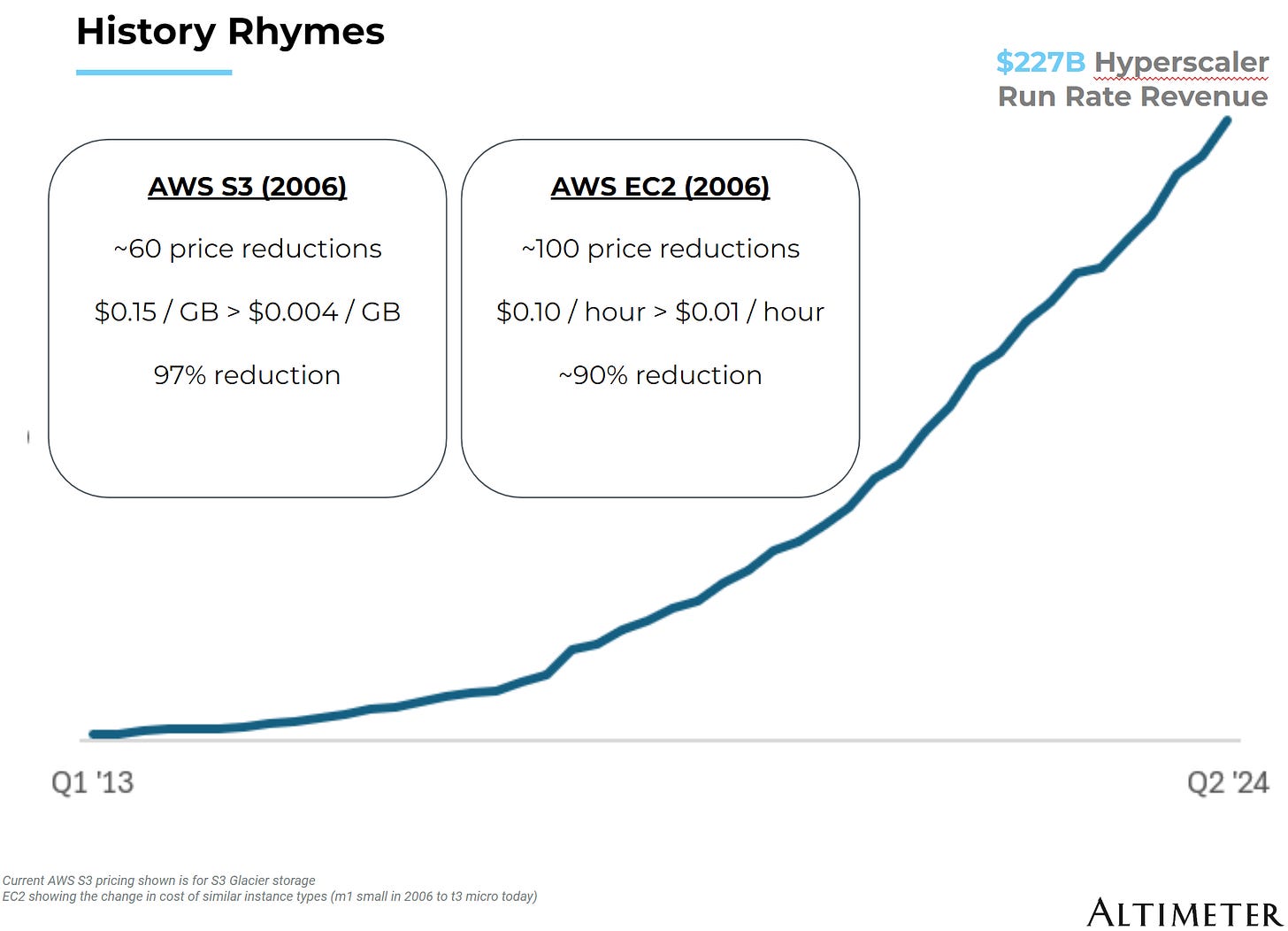

If we rewind the clock back 15+ years, the product portfolios of the public cloud players were quite limited. There was a consensus at the time that these services would one day become a race to the bottom commodity. However, a couple things happened. The cloud turned out to be a much bigger opportunity than anyone ever imagined.

—Jamin Ball, Altimeter Capital

History does not repeat itself but it does rhyme.

And just like I think we are in an AI bubble, which in hindsight will look just like the dot.com bubble, I think the dire warning of “foundational models will be commoditized”, misses the point of what’s actually going on.

Everyone remembers Pets.com, Webvan, and “irrational exuberance”, but people often forget Amazon, Google, and Salesforce came out of the same class of companies.

The Reports of my Death are Greatly Exaggerated

Forgive the second Mark Twain quote in as many lines, but the most recent, frenetic, mid-wit take I’ve been hearing a lot about AI is that:

“the numbers just don’t make sense. The models will become commodotized and then what happens to venture ROI as it becomes a race to the bottom?”

AI is like the cloud infrastructure boom, as

put forward in his recent article. And as you’ll see, the cloud infa companies are doing just fine, thank you very much.Infrastructure as a Service

S3 was one of the early, foundational services provided by Amazon Web Services (AWS) when cloud computing was in its infancy.

But it wasn’t just storage; it was highly scalable, reliable, and designed to be the backbone for applications, giving developers a simple way to store and retrieve data at massive scale.

Over time, S3 also became a core building block for the entire cloud ecosystem, essential for everything from machine learning to media streaming to enterprise backups.

I’m sure you’ve heard of a few of them:

Netflix

Twitch

AirBnB

Spotify

McDonalds

Capital One

Coca-Cola

All of these companies leverage AWS for their cloud computing needs.

So let’s think about this now for a moment.

Similar to how S3 provides infrastructure for data storage, foundational AI models provide a robust infrastructure for various AI tasks—language, vision, code, etc.—enabling developers and researchers to build on top of this pre-trained knowledge base without starting from scratch.

Just as S3 abstracts away much of the complexity of data management, foundational models abstract away the complexity of feature engineering, training from scratch, or collecting massive datasets. Developers focus on applying these models rather than reinventing them.

Netflix doesn’t worry about buying and powering server farms. It just worries about making good content.

This is the only path forward. Unless you’re a hyperscaler, or an AGI lab, you shouldn’t be in the foundational model business. You should be in the application layer business.

Extrapolate

The idea that foundational models will get commoditized mirrors what happened with public cloud infrastructure like S3.

Early on, S3 and cloud services were seen as revolutionary.

But as more competitors entered the space (Google Cloud, Microsoft Azure, etc.), cloud storage became more of a commodity, differentiated mainly by price, geographic reach, and integrations.

The key here is that innovation shifted from the infrastructure itself to the services built on top of it.

As more players (e.g., OpenAI, Google, Anthropic) build large foundational models, the initial advantage of having a state-of-the-art model diminishes over time.

Differentiation could shift from the model itself to how it’s deployed, optimized, or fine-tuned.

Foundational models could become infrastructure-like in the sense that they are ubiquitous and treated as interchangeable by end users.

Just as end users don’t care whether Netflix is run on AWS S3 or Google Cloud Storage, AI end users won’t care if their favorite applications are run on GPT or Claude, so long as it works for their specific use case.

So why does this chart look like this? If cloud services were commoditized, why did the AWS segment of Amazon record $26.3 billion in revenue in Q2 2024, marking 19% year-over-year growth?

Despite significant price reductions over time, AWS remains extremely profitable due to its scale, integrated services, and premium offerings. The operating income for AWS last quarter was $9.3 billion, which translates to an operating margin of about 35.5%.

Beyond basic compute (EC2) and storage (S3), AWS offers over 200 fully featured services, including databases, analytics, machine learning, and IoT. These value-added services often carry higher margins and create additional revenue streams.

AWS consistently introduces new services and features, staying ahead of competitors and meeting evolving customer needs. This innovation attracts and retains customers willing to pay for advanced capabilities.

And the wide array of AWS services are designed to work seamlessly together. This integration creates a sticky ecosystem where customers find it convenient to use multiple AWS services, increasing their reliance on the platform.

So in a sentence: AWS was commoditized long ago, but is still extremely profitable due in large part to its application layer technologies and ecosystem.

It doesn’t matter that the foundational layer is commodotized. It matters that the foundational layer works well, and the jobs-to-be-done are solved at the application layer.

Conclusion

Despite S3 dropping nearly 97% in price, and EC2 falling nearly 90%, the public cloud providers built behemoth businesses (with high margins). The same will hold true in the AI innovation space.

If your use case only requires GPT 3.5 level intelligence, you can download Llama from Hugging Face today for free and fine tune it for what you need.

But the so-called frontier models will continue to advance, which is great news for the consumer. Year over year, these frontier models will get better. And year over year, they will get cheaper.

But what about businesses. Tell me about the money. Isn’t that what I’m refuting in this post? That AI is a money pit?

CapEx is up. NOPAT is up more. Why is that? Because they're doing exactly what you would expect to happen in a world of AI, they're trading off human labor against GPU hours.

That's why the return on invested capital (ROIC) has gone up. Because the GPUs are really efficient.

Let's have an AI ROI debate, with ROIC included, for all the big AI spenders. Until then, it's just the height of intellectual ridiculousness. I mean, ridiculous, to say that there is no ROI for AI CapEx.

I don’t think people have really grasped the concept of what is coming. They see a chatbot that can write a term paper. Or they remember Microsoft Clippy when they think of an agent

People couldn’t see use cases for the cloud.

Or the iPhone.

Why would I use a touchscreen when I’m twice as efficient on my Blackberry?

Why would I trust a different company with my data when I have my own prem server?

Change happens slowly, then all at once. And we’re about to be living in a world where AI is not only commoditized, but ubiquitous. That’s the ‘so what’.

It certainly will become commoditized. The question will be, as all of this infrastructure becomes more and more centralized, the world is in danger of one well launched cyberattack or one bad update bringing the entire world to its knees. Cloud computing certainly cut the local hardware infrastructure. It also showed the world how far behind the US is in inexpensive high speed access and one cloudstrike update away from chaos.

Ahhh ha! Now I understand!